Marketing and Empathy Psychology

New Overtime Rules for 2024 & Worker Categorization

By - Dr. Robert K. Minniti

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- 06 Aug - 21 Oct 2022

- 10:00 - 12:00

- October 11, 2024 | Available all day |

- 100

Learning Objectives:

- Review the methodologies for categorizing workers

- Review the new overtime rules

Program Description:

In August of 2023 the Department of Labor released a proposal for new rules for paying overtime to nonexempt employees? Are you familiar with the new rules, do you have any questions about implementing the rules? Businesses are also having audit issues with the way workers are categorized. Do you know all the IRS rules for how to categorize an employee? Are you familiar with the new rules for independent contractors?

This course will review the IRS and Department of Labor rules. This course would be appropriate for CFOs, CEOs, business owners, business managers, internal auditors, human resource employees, human resource managers, external auditors, corporate accountants, government accountants, CPAs, CMA, CIAs, CGMAs, MAFFs, CFFs, payroll personnel and risk management personnel.

Vulputate eros arcu magnis donec sem pretium scelerisque a etiam. Eros aliquam elit si mattis phasellus at orci letius ligula posuere. Sodales maecenas facilisis diam egestas dictumst si fames mus fermentum conubia curabitur. Ornare nisi consectetur semper justo faucibus eget erat velit rhoncus morbi.

Speaker Detail

Dr. Robert K. Minniti

Dr. Minniti is the President and Owner of Minniti CPA, LLC. Dr. Minniti is a Certified Public Accountant, Certified Forensic Accountant, Certified Fraud Examiner, Certified Valuation Analyst, Certified in Financial Forensics, Master Analyst in Financial Forensics, Chartered Global Management Accountant, and is a licensed private investigator in the state of Arizona.

Webinar Information

- Duration : 100

- Date: October 11, 2024 | Available all day

- 06 Aug - 21 Oct 2022

- 10:00 - 12:00

- Jakarta, Indonesia

Share this event

Related products

-

Employee Retention 2024: This is not your 2010s workplace

$199.00 – $349.00 Select options -

Investigating ADA, FMLA, and Worker’s Comp Abuse

$199.00 – $349.00 Select options -

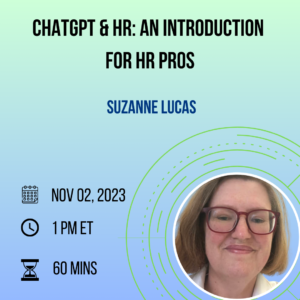

ChatGPT & HR: An Introduction for HR Pros

$199.00 – $349.00 Select options -

Multi State Payroll Compliance

$199.00 – $399.00 Select options