Marketing and Empathy Psychology

2024 Payroll Boot Camp: Elevate Your Expertise

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Tab #1

Tab #2

Tab #2

Tab #1

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Tab #2

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Tab #2

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Webinar 1

Webinar 2

Webinar 3

Webinar 4

Webinar 1

Payroll Deductions in 2024: What Can and Cannot be Deducted from an Employee’s Wages

- DURATION : 60

- DATE / TIME(EST) : November 6, 2024 | 12:00 am

- SPEAKER : Vicki M. Lambert, CPP

Overview:

In this webinar we will discuss what can and what cannot be deducted from an employee’s regular paycheck as well as their final one. Failure to follow the regulations pertaining to employee wage deductions can result in substantial penalties and interest.

Background:

In payroll we calculate the gross wages of an employee by meticulously following strict regulations on what must be or must not be counted as hours worked and taxable income. We pay the employee their net paycheck only by the payment method that is permitted. But what about in between? When it comes to deducting from the employee’s gross wages to achieve the net income are you also adhering strictly to the rules?

After calculating gross wages for an employee is accomplished, much more difficult decisions must be made. What must an employer deduct from an employee’s wages? What can be deducted legally? What can never be deducted? These questions and more must be answered correctly before processing that paycheck. And if this is the employee’s final check…the rules may change! Handling deductions is a complex task that payroll must get right every time for every payroll check. Failure to deduct the proper taxes could result in penalties on the employer from the IRS but making an illegal deduction for a fringe benefit or for collecting an overpayment can get the employer a visit from the federal Department of Labor auditor, the state department of labor auditor or both! Sometimes the federal government will allow the deduction but that certain state won’t.

Of course, everyone knows that payroll deducts for federal and state taxes. However, how much input does the employee have concerning these deductions? This will be answered in this webinar. Which taxes are mandatory, which are a courtesy and which ones the employee controls will be explained during this webinar. If the IRS or the state wants payroll to collect for back taxes; how is that processed? What does payroll do if a “payday loan” deduction is received as opposed to a creditor garnishment? Which ones must we honor and why. We will discuss this during this webinar

Fringe benefits are a normal part of payroll for most employees. Deducting for voluntary fringe benefits such as health insurance or group term life can usually be an easy task. But what about health insurance under a medical support order? Does that change how it is processed by payroll? We will discuss processing voluntary and involuntary health insurance deductions.

Many employers require their employees to wear uniforms for work. Can the cost of the uniforms and their upkeep be deducted from an employee’s wages? What about cash shortages or breakage? Can I deduct the cost of shortage or breakage from the employee’s paycheck under the state or federal laws

Some employers offer meals and lodging as part of the employee’s work contract. What can be deducted from the employee’s paycheck for employer provided meals and lodging and can this be used as credit against the minimum wage paid

What if an employee is overpaid? Can the employer simply deduct the overpayment from future payments or does the employee have to agree to the deduction in writing? Does the federal law differ from the state law in this area and, if it does, which one does the employer have to follow

Many employers advance vacation for their employees to ensure that all employees are rested and working at peak efficiency. But what if the employee takes their vacation in advance and then leaves the company? Can an employer recoup advanced vacation hours from the employee’s final check under federal or state laws

Many employers give loans, advances on wages to employees or allow employees to purchase items from the employer. We will discuss how these can be recouped or repaid if the employee stays or if the employee terminates.

Areas covered in this webinar:

- Taxes—which are mandatory, which are a courtesy, and which ones the employee controls

- Child support—the limits but not beyond

- Tax levies—federal and state

- Creditor garnishments—how many can you honor and how often

- Voluntary wage assignments for “payday loans”—when are they required to be honored

- Handling fringe benefits such as health insurance or group term life

- Uniforms—when the employer pays for it and when the employee furnishes it

- Meals—when they become part of the employee’s wages

- Lodging—when it is part of the employee’s wages and when is it a perk

- Shortages—the employee came up short, so they must cover that right?

- Breakage—you broke it, so you have to pay for it, legal or not?

- Overpayments—the employee was overpaid so you can just take the money back, or can you?

- Advanced vacation pay—the employee knows the vacation hours were advanced so we can take them back when the employee quits can’t we?

- Loans to employees: what terms can be set while the employee is still active and what can be taken when the employee terminates

- Employee purchases—active employees and terminated employees

- Anti-wage theft laws and the states

Who can Benefit:

- Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

- Human Resources Executives/Managers/Administrators

- Accounting Personnel

- Business Owners/Executive Officers/Operations and Departmental Managers

- Lawmakers

- Attorneys/Legal Professionals

- Any individual or entity that must deal with the complexities and requirements of paying employees

Webinar 2

Payroll Overpayments: Handling them Correctly in 2024

- DURATION : 60

- DATE / TIME(EST) : November 6, 2024 | 12:00 am

- SPEAKER : Dayna J. Reum, CPP

Overview:

We will discuss these regulations and more including the private letter ruling that governs the IRS requirements. We will examine the FLSA requirements on recouping overpayments including the 1998 opinion letter that spells out these requirements. We will also discuss how to conduct research to determine the state’s requirements for handling overpayments. We will review the wage and hour laws of several states and the factors that they use to determine if an overpayment can be recouped.

Background:

Employees can be overpaid in even the most well managed payroll department. Yes, it does happen when mistakes are made but it isn’t always the result of an error. Perhaps the employee received a sign on bonus but did not stay for the required length of time. Or the employee was advanced vacation but is now terminating before he or she has fully earned the time. No matter the reason, overpayments can and do happen and must be handled properly. The first questions that usually arise relate to IRS regulations. What is required if the overpayment occurred this year? But what if it occurred in a previous tax year, does that change the rules? Are the rules different for federal income tax than they are for social security or Medicare taxes?

Recouping overpayments is also much more complex than just adhering to IRS code! Wage and hour law compliance must also be honored when dealing with overpayments. Before the payroll department even needs to determine IRS requirements they must first determine if recouping the over payment is even legal under the FLSA. Issues such as exempt employee status, minimum wage and overtime rules for nonexempt employees must be considered when recovering overpayments from employees.

And of course, the overpayment did not occur in a vacuum when it comes to state laws. Each individual state may have their own compliance issues involving wage and hour laws! Is there a time limit for recouping the overpayment in that state? Does the employee have to be notified in advance before the deductions can begin? Or does the state just say NO! to the whole process?

Areas covered in this webinar:

- Handling Overpayments under IRS and State Tax Codes:

- Why a 1990 IRS Private Letter Ruling on handling overpayments applies today

- Correcting overpayments in the same calendar tax year

- Why asking for the gross is better than the net check for prior year overpayments

- Correcting FICA taxes for a prior year overpayment

- Correcting FUTA/SUI taxes

- Using Form W-2 or Form W-2c to report overpayments

- Wage and Hour Laws and Their Impact on Recouping Overpayments:

- The standards under the FLSA in terms of timeframe for recouping prior year overpayments

- Is a written agreement for repayment always required under the FLSA

- Collecting overpayments from exempt employees and its effect on salary basis compliance

- Recouping overpayments and its effect on minimum wage and overtime requirements

- Can employers treat advanced vacation payments as overpayments if an employee terminates

- Where do the states stand on recouping overpayments

Who can Benefit:

- Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

- Human Resources Executives/Managers/Administrators

- Accounting Personnel

- Business Owners/Executive Officers/Operations and Departmental Managers

- Lawmakers

- Attorneys/Legal Professionals

- Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

Webinar 3

Payroll IRS Form Review

- DURATION : 60

- DATE / TIME(EST) : November 6, 2024 | 12:00 am

- SPEAKER : Dayna J. Reum, CPP

This webinar is designed to help the participant to be updated on 2023 Payroll IRS forms, necessary to stay in compliance with the IRS. Did you know that penalties for information returns have been updated and can cost your company money if W-2’s and the required ACA forms are not filed properly? These kinds of items and many more will be reviewed. We also will review the most updated information available on tax reform and the potential impact on payroll.

Benefits of attending:

- To understand where we are in current legislation

- To understand the possible impacts of tax reform

- Update on where legislation is with Tax reform and what the IRS is saying.

- Annual updates you need to be aware of

- Form updates and how to handle them for 2019

- Tax Reform and how it will continue to impact how payroll functions

Topics covered in the webinar

- Form 941 & Form W-2

- Deadline Updates for 2023/2024 for W-2 reporting

- Changes to the Form 941 for 2019

- Form W-4

- 2023 updates

- Annual Taxation Updates

- Deferred Comp

- IRS Limits (Mileage, transportation, etc)

- Taxation of Fringe Benefits

Webinar 4

Multi State Payroll Compliance

- DURATION : 60

- DATE / TIME(EST) : November 6, 2024 | 12:00 am

- SPEAKER : Dayna J. Reum, CPP

Understanding how to calculate tax for employees in 2 or more states can be confusing. Plus what state laws for payroll need to be followed when employing employees in more than one state.

To better understand the laws in each state and the tax guidance on how to determine taxation when employees live in one state and work in another. Or for employees that work in multiple states for travel for work. Also other state laws that affect payroll will be discussed.

This webinar will discuss how to deal with the complicated multi state taxation concerns when creating a remote work policy. Along with temporary COVID-19 legislation that has impacted multi state concerns. We will also cover details about understanding DOL in multi-state environments.

Learning Objectives:

- Review how to properly determine SUI state

- Understanding multi state taxation and how to properly review the laws to stay compliant

- Best practices on how other employers handle multi state concerns

- Details of states and how to handle the state withholding forms versus using the federal from

- When employees move states while employed with the same employer and what payments should still be taxed in a prior state

- Understanding reciprocal agreements

- Review of why employee residency is important

- What is Nexus and what does it mean for the employer taxation requirements?

- Review an employer DOL liability for a multi state employee

Webinar Information

- DURATION : 75

- DATE / TIME(EST) : APRIL 10, 2024 | 1:00 PM

- SPEAKER :

Share this event

Related products

-

Employee Retention 2024: This is not your 2010s workplace

$199.00 – $349.00 Select options -

The DOL Predicts that the Overtime Rule would be Launched in April 2024! Employers Need to Prepare for Compliance!

$199.00 – $349.00 Select options -

Legal & Ethical Challenges for Employers: An Increase In Burnout, Stress, & Mental Illness

$199.00 – $349.00 Select options -

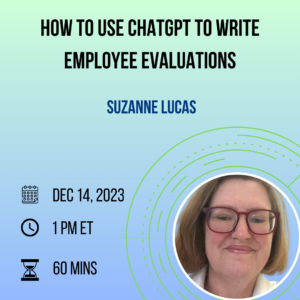

How to Use ChatGPT to Write Employee Evaluations

$199.00 – $349.00 Select options